Yesterday, GE Vernova hosted its 2025 Investor Update event in New York City. We see a stronger financial trajectory ahead with substantially higher returns expected beyond 2028. We raised our multi-year financial outlook, and announced that our Board of Directors approved the doubling of our dividend and increased our share buyback authorization. We also reaffirmed our 2025 revenue and adjusted EBITDA margin* guidance, raised our 2025 free cash flow* guidance and presented our 2026 financial guidance.

We encourage you to review the replay of the event and its accompanying materials, which can be accessed on GE Vernova’s investor relations website here.

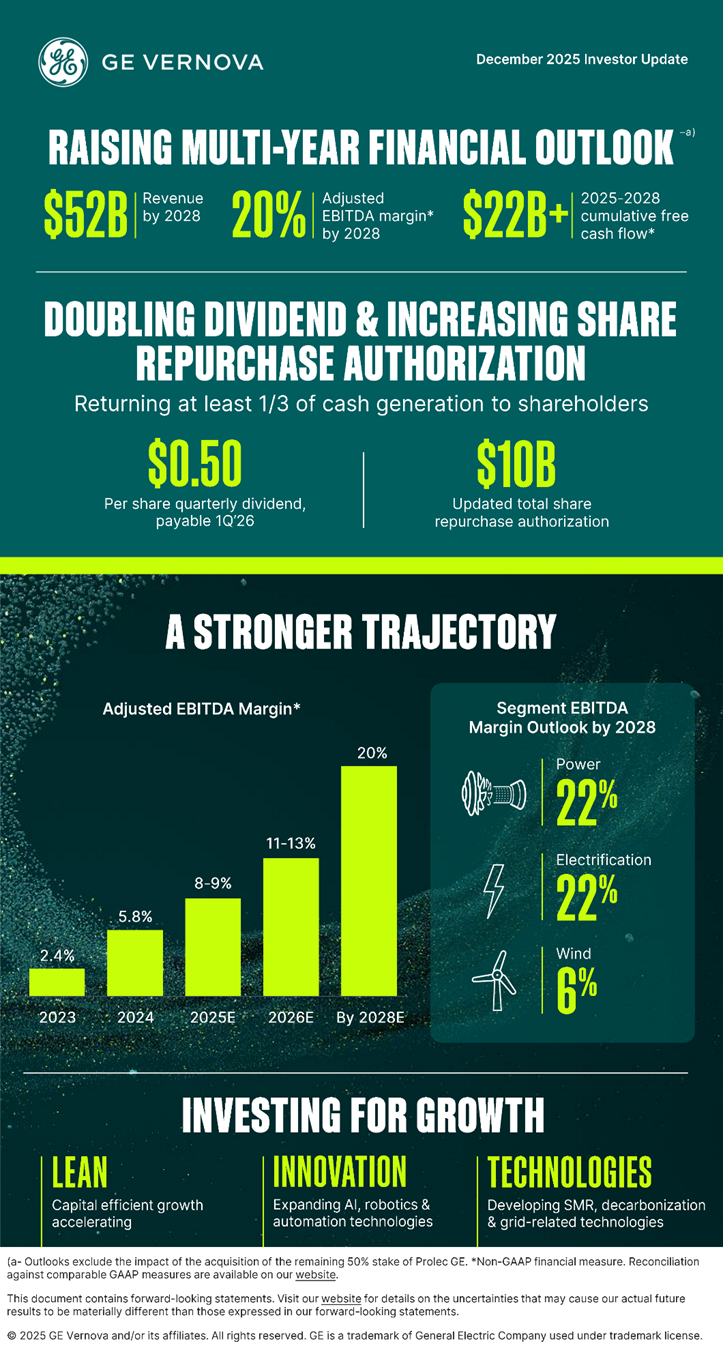

Multi-year financial outlook updates:

- 2025 guidance: continue to expect $36-$37B of revenue, trending towards the higher end of the range, and 8%-9% adjusted EBITDA margin*; increased our free cash flow* guidance to $3.5-$4.0B, up from $3.0-$3.5B

- 2026 guidance: expect $41-$42B of revenue, 11%-13% adjusted EBITDA margin*, and $4.5-$5.0B of free cash flow*

- By 2028 outlook: now expect $52B of revenue, low-double digits1 organic growth*, up from $45B, high-single digits organic growth*; 20% adjusted EBITDA margin*, up from 14%; and $22B+ of cumulative free cash flow* from ’25 to ’28, up from $14B+

Our guidance and outlook exclude the acquisition of the remaining 50% of Prolec GE.

Other key information:

- 18 GW of gas turbine contracts signed quarter-to-date; expect to reach 80 GW of combined slot reservation agreements and backlog2 by year-end

- Expect to grow total backlog from $135B to approximately $200B by year-end 2028, inclusive of doubling the size of Electrification backlog from $30B to $60B

- Expect to generate at least $22B of cumulative free cash flow* from 2025 to 2028, up from at least $14B, after investing approximately $10B in cumulative capex and R&D in that time

- Board of Directors declares a $0.50 per share quarterly dividend, payable in the first quarter of 2026, and increases share repurchase authorization to $10B, from $6B

GE Vernova CEO Scott Strazik said, “At GE Vernova, we are in the early chapters of an incredible value creation opportunity with a stronger financial trajectory ahead. Electric power will be critical to unlocking economic growth in the decades ahead and we are well-positioned with our large installed base and platform of advanced solutions to serve this growing, long-cycle market. We will deliver value in the short term, but I’m most excited about our long-term potential as we focus on value-accretive capital allocation to drive growth and innovation while delivering shareholder returns. We are executing efficiently, and there is more to come as we enter 2026 with significant momentum.”

GE Vernova CFO Ken Parks said, “We are executing our financial strategy, and we now expect to generate at least $22 billion in cumulative free cash flow by 2028. Our large and growing backlog, with healthy margins from services and better equipment pricing, is furthering our momentum into 2026 and driving our increased outlook by 2028. We remain committed to maintaining an investment grade balance sheet as we make organic investments, pursue targeted M&A, and return at least one third of cash generation to shareholders through our higher dividend and increased share repurchase program.”

Growth beyond 2028:

GE Vernova is well-positioned to deliver substantially higher returns beyond 2028, including from its:

- Large and growing equipment and services backlog, which is expected to reach approximately $200 billion by year-end 2028.

- More profitable, recurring Gas Power services revenue beginning in the 2030s.

- Expanded investments into artificial intelligence, robotics, and automation.

- Focus on developing and commercializing breakthrough energy technologies, including small modular nuclear reactors, carbon capture, solid oxide fuel cells, and grid-related technologies to support data centers and grid modernization.

We are building a unique, differentiated company with a culture and team motivated to reach our long-term potential for our customers, investors and the world. To stay in touch with future GE Vernova releases, please visit our website and sign up for email alerts. We thank you for your interest in GE Vernova and look forward to connecting with you in the fourth quarter.

Best,

Michael & team

1Compound annual growth rate through 2028; 2025 is the base year

2Defined as remaining performance obligation (RPO)

*Non-GAAP Financial Measure. The reasons we use these non-GAAP financial measures and the presentations of and reconciliations to their most directly comparable GAAP financial measures are included in our 2025 Investor Update press release and presentation slides posted on our Investor Relations website at https://www.gevernova.com/investors.

This document contains forward-looking statements. Forward-looking statements provide current expectations of future events based on certain assumptions. Words such as “expects,” “intends,” “plans,” “guidance,” “outlook,” and similar expressions, may identify such forward-looking statements. Except as required by law, we disclaim any obligation to update any forward-looking statements.